feature image via Shutterstock

There are a whole lotta benefits to renting, like not having to replace your refrigerator when it breaks or being able to pack up and move if your neighbors are awful. My partner and I rented for seven years in various roommate configurations, but after a while, when it was clear we were going to stay in the city we live in, we decided to stop throwing our money into a bottomless pit. We decided we’d like to own a little piece of Planet Earth to call our home.

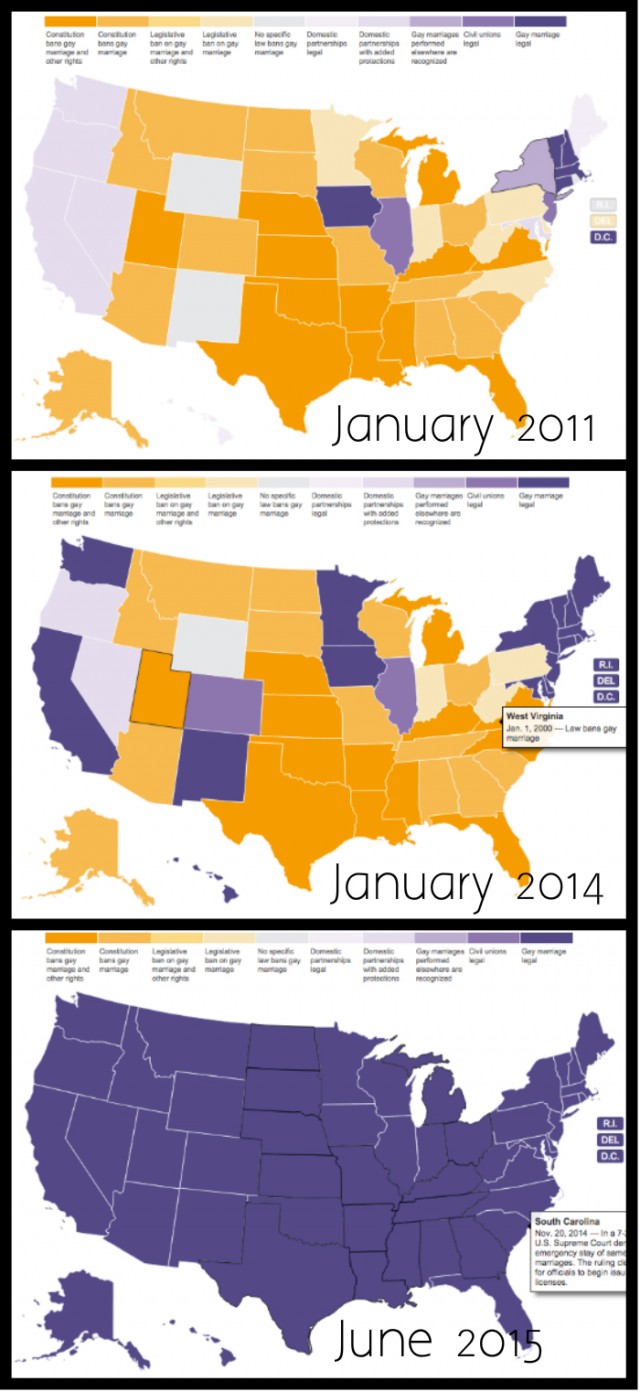

We’re not alone! Since the 2015 SCOTUS ruling in Obergefell v. Hodges, federally recognized marriage equality means that married LGBT couples have access to the same protections that heterosexual couples enjoy when purchasing property together or raising children together. According to a recent survey of their 1500 members, the National Association of Gay and Lesbian Real Estate Professionals (NAGLREP) found that 47% of their members believe more LGBT married couples are buying homes than prior to the federal marriage equality decision.

Marriage equality map over time from the L.A. Times chronology map

It can feel like a big thing, buying your first home. There’s a lot of money and planning and legal stuff involved and lots and lots and lots of paperwork.

Like most things in “grown-up” life, home-buying decisions for LGBTQIA people comes with unique considerations and challenges.

For example, depending on where you live and what your community is like, you may or may not be able to find an LGBTQ real estate agent. You may not even be able to find an openly LGBTQ-friendly real estate agent. Your agent may or may not know which neighborhoods are queer-friendly or may have misconceptions about what that even means and drop you into the affluent gay white neighborhood when you’d rather be in a different part of your city/town/county/whatever-kind-of-municipality-you’re-buying-in.

If you’re buying with a partner or partners, it’s imperative that your attorney knows what the laws are and what kinds of tenancy agreements are available to you that best protect your family. That’s on top of the stress of budgeting for, finding, getting approved to buy, putting an offer in on, and managing a timely closing on a home. Welp.

As a home-owning queer person, I’m here to help!

Deciding You’re Ready to Buy

via Shutterstock

What Is Your Life?

Before you commit to buying a home, you need to honestly assess where you are in your life. Buying a house is a huge commitment and it may or may not be a good fit for you right now.

- Do you feel certain you want to live in the same place for at least five years? If not, what would you do with your home if you decide to move in the near future? Are you open to renting it and being a landlord if you move? Could you sell it and recoup your costs quickly?

- Do you like the idea of being “tied down” to one place or do you want the flexibility of renting that allows you to move quickly and (relatively) affordably? Do you want the responsibility of caring for and being in charge of a home?

- Are you planning to buy with another person or more than one person? If so, who are you buying with? A family member? Friend(s)? Romantic partner(s)? A spouse? What kind of relationship do you have with this person or persons? How stable is your relationship with them? How are they with managing and contributing money and finances or non-monetary value to your household? Do you feel safe entering into a long-term financial contract with them?

- What are your future aspirations? Do you see yourself pursuing any major career, life, education, or family/relationship changes in the near future? What are those changes and how do they impact your readiness to buy?

Do You Have the Cash Money?

Traditional financial advice recommends a 20% downpayment on a home. Ha! I literally know no one who has been able to afford that, not in this recession economy! Many folks, including myself, took advantage of a first-time homebuyers program that requires a smaller down payment, as little as 3% down.

There are other immediate costs in addition to the downpayment, including the home inspection, closing costs, any immediate repairs that need to be made, and the mortgage application and appraisal fees. There’s also homeowner’s insurance, private mortgage insurance (which is additional insurance you’ll need if you’re putting less than 20% down), and property taxes to be paid.

You can sometimes get the seller to pay up front for the closing costs. You can also usually ask a seller who is motivated to sell to make necessary repairs to the property before you buy as part of your agreement.

- Do you have or can you get together the cash for a down payment, closing costs, homeowner’s insurance, private mortgage insurance (if applicable), and the other costs of buying a home?

- Is your credit score decent? You’ll need a good credit score or a co-signer with a good credit score to qualify for a loan.

- Is your debt-to-income ratio (including school loans, credit card debt, utility bills, etc.) manageable enough that a mortgage payment would be within your budget? Are you financially prepared to be locked into a long-term financial commitment like a mortgage? A mortgage is a pretty big deal and if you can’t afford to pay, you can really screw up your credit score and literally end up homeless.

- If buying with someone else, what is their financial snapshot like? What can they contribute? What does their credit look like?

Assess Your Personal Values

Finally, sometimes it helps to make a good ol’ pro and con list of renting vs. buying. It will help you assess what your values are around home ownership and whether it really makes sense for you right now.

- What are the reasons you might want to buy? Why might you be better off renting?

- What are your expectations for owning vs. renting?

- If buying with someone else, how stable is that relationship? Do you have the trust in your relationship each other you need to enter into a major legally binding purchase? How will you protect yourself and your assets if the relationship ends for any reason (break-up, divorce, moving, death)?

Getting Your Financial Shit Together

via Shutterstock

Assess your financial plan before you even begin looking at houses. You don’t want to do it in the reverse, which could result in you being seduced into buying a home or entering a financial agreement that isn’t a good fit or, worse, could bankrupt you. There may be a nonprofit or housing program that offers first-time homebuyer classes in your neighborhood, which can be a good place to start learning about the costs of homebuying near you, as well as hook you up with local resources.

How Much House Can You Afford?

There are two ways to approach this question: 1) How much mortgage can you get preapproved for from a bank? and 2) How much can you reasonably afford to allocate to a mortgage payment in your household budget?

You may be able to get a bank to preapprove you for $300k, but that doesn’t mean you should necessarily go out and buy a $300k house. What other expenses do you have that impact your budget? Do you have education loans? Credit card debt? Medical debt? What are your transportation, phone, and grocery costs? Do you have children or dependents? Pets?

Inclusive of all your expenses and income, what can you actually afford to spend on your home? Figure out this number before you even apply to get pre-approved for a mortgage, so you know what is actually reasonable and you’re not tempted to buy above what you can afford.

Check Your Credit Score

Get a free copy of your credit score and report. Many credit card companies offer this service for free. You can also access your report for free at MyBankrate or at the federal free credit report site. Credit scores are between 300-800; the higher, the better. Check your report for errors. If your score is low, you may have a hard time getting a mortgage loan and you may want to work on building your credit before you pursue home ownership.

Get Pre-Approved

Before you start seriously considering homes, you should get pre-approved for a mortgage by a bank or lender. You should get more than one quote and see who is offering you the best APR rates and options. If you’re a member of a credit union or co-operative bank, that can be a great place to start. Your real estate agent may also have suggestions about mortgage professionals. Don’t feel pressured to use your real estate agent’s (or anyone’s) recommendation. Do check out all your options.

I didn’t follow this advice at all because I found our perfect-ish home before I was preapproved and wanted to move quickly, but I would totally recommend it in an ideal situation. Don’t be getting preapproved over the phone while waiting for your flight to board in an airport on a Saturday morning from a lender you’ve never met. It worked out fine for us, but it could have been a major misstep.

Research First-Time Homebuyer Loans, Grants, and Programs

There are a bunch of federal, state, and local programs to assist homebuyers. See what’s available where you live. Read up on federal programs and state programs you might benefit from or qualify for.

Finding Your Dream-ish Perfect-ish Home

via Shutterstock

Unless you’re buying bare land and building your dream home from the foundation up, you’re probably not going to find a house with picture windows and a Jacuzzi tub and an open floor plan and a giant slide from the attic to the basement.

Make a Dream List

Sit down and write down (literally, write it down) a list of your:

- Must haves

- Wanna haves

- No ways!

Think about things like location, green space, storage space, the number of bedrooms and bathrooms, square footage, type of floor plan, accessibility, parking and/or transportation, your commute to school or work, the type of heat and energy, and whether you want a fixer-upper or a move-in ready home.

Dream big! Then, decide what you really, really need and what you can live without or buy/add/fix later on. Don’t fret too much about the color of the paint or wallpaper, the ceiling material, the lack of landscaping, or other things that you can probably alter over time relatively inexpensively.

Even though I know those shows are fake, every time I see a Househunters where someone refuses a place because of the wall color or popcorn ceilings, I want to shake them vigorously.

It’s good to know what you want, but don’t let your dream list prevent you from finding the right home. If you’re buying with a partner or partners or roommates, you may find you have very different dream lists.

The Internet is Your Friend

There are so many listings online. Zillow and Trulia are two popular websites to look at homes for sale and to compare homes by location. They both also show home values for homes that are off the market (not for sale) so you can compare the listing price of a home to other homes in the area. You can also see what the home last sold for and how it has appreciated or depreciated in value over time at both sites.

There’s no reason not to start looking online right now and start to get a sense of what kind of houses interest you. It could help you build your dream list!

Get in the Door at an Open House

Another low-commitment way to start looking at houses is to attend open houses, usually hosted by realtors looking to sell a property quickly. Open houses are advertised in the classified ads of your local papers, online on realtor sites, and through word of mouth.

You typically have free access to the home. The owner isn’t there while the open house is happening, so you can feel free to open closets and cabinets, explore the basement and backyard, test the water pressure, etc.

The realtor will be there and may pressure you to state your interest, so keep that in mind. It’s best to talk about the house later, not in front of the realtor, especially if you might actually be interested. Remember you will be negotiating with the seller, so expressing interest to a seller’s realtor might encourage them to be firm on the asking price. Ask questions, but leave the freaking out over the original hardwood floors for after the walk through.

Hire a Damn Agent

Yes, you can buy or sell a house without a real estate agent, but you know what you probably don’t know a lot about? REAL ESTATE. Real estate practices and law differ from state to state. Buying a home is a huge project to manage on your own. Most buyer’s realtors are paid through the sale of your house on commission, so you’re not paying them directly. (If you’re selling a house, your seller’s agent will take a cut of your profit, just FYI). When you’re ready to start looking at houses seriously, ask around for recommendations of an LGBT-friendly agent.

Once you’ve found someone, you’ll meet with them to share what your budget is, what neighborhoods you’re looking in, and what you want in a house. They’ll provide some advice, including if your expectations are reasonable. They’ll search listings for you and make recommendations of homes to see. You can also ask them to book showings of any houses you find online or through listings that you’re interested in. If you decide to put an offer on a house, your agent will work directly with the seller’s agent and hustle to make sure you close on time by advising you through the process. They are usually also able to recommend an attorney, which you will want and need to draw up the legal paperwork.

Go On the Hunt

Start looking at lots of homes, so many homes, more homes than you think anyone should look at! It can be overwhelming, so you may want to take pictures or video of each and keep a notebook with notes on all the houses you see. If you want to be really extra, you can create a scoring rubric. Consider whether the properties meet your dream list needs and definitely take into consideration the overall structure of the property.

- Run the water in the sinks to test the water pressure and water heater. Flush the toilets to see what the pressure is like.

- Open windows and doors to see if they stick and fit properly.

- Turn light switches on and off to test the electrical system.

- Note the kind of heating (gas, electric, forced air, etc) used, which can drastically impact your utility bill

- Peek at the circuit box and see how many circuits the house has and if there are any free ones

Buying Your Real Adult Home

via Shutterstock

Here’s how it goes down once you’ve found the home you want to claim as your own. Here’s where things get really real. Get ready to move quickly so you close on your house on time, which just means that all the legal and contractual obligations are met within the required time frame. If your closing is delayed and it’s your fault, the seller could renege on your offer and sell to someone else.

Making the Offer

You’ll come up with a number that you are willing to pay, which may be less or more or exactly the same as the asking price. That all depends on your financial circumstances, how in demand the property is, and on how motivated the seller is to get out. Your agent will draw up the offer for you to sign and will communicate the offer to the seller’s agent.

Your offer should be in writing (oral offers don’t hold up in court) and must specify the offer price and all other terms and conditions of the purchase. For example, if the seller agrees to put money towards your closing costs (called a “seller’s concession”) or include $10,000 for roof repair, that should be in writing in the offer. Many offers are contingent on a home inspection, which should be in writing including the time frame during which the home inspection will occur.

An offer will also often include “earnest money,” which is a cash amount that you are offering to make on the house immediately. The earnest money will go towards your escrow and shows that you are serious about buying.

Once you’ve made the offer, the seller can choose to accept or reject it or to reply with a counter offer, which you can accept, reject, or counter back with new terms.

Another thing that can happen is that the another person can put their offer in and you can end up in a “bidding war,” increasing your offer amount until one of you drops out.

Until your offer is accepted by the seller, you aren’t contractually bound to the property and the seller isn’t obligated to sell to you. Once it is accepted in writing, both you and the seller are locked in legally. You’re on your way to owning your home, cupcake!

Inspections, Appraisals, and Mortgage Approvals

Home Inspection

You’ll schedule a home inspection soon after your offer is accepted, usually in the first two weeks or whatever the laws in your area require. The home inspector will send a report to you and the seller. If there are repairs that need to be made, you can request the seller make the repairs before closing. The inspection cost is built into your closing costs or can be paid upfront.

Mortgage Loan

You’re also going to need to prove your income to your mortgage lender, who will go over your bank statements, income, financial history, and credit report with a fine-tooth comb. If you know you’re planning to apply for a mortgage, don’t open new credit or do anything that could impact your credit score. Don’t make a big withdrawal or deposit that can’t easily be accounted for. The interest rate you are offered for your mortgage loan depends on how creditworthy you are.

You can choose to lend from any lender, not just lenders who pre-approved you. You can also choose from different types of mortgages based on your preferences: a 30-year if you want smaller payments or a 15-year if you want to build equity and pay off the loan faster. There’s also a fixed rate if you want to have a reliable never-changing interest rate on your mortgage or a variable rate if you want a lower initial APR and can tolerate some fluctuation in the future based on the market. What you choose may depend on how long you plan to own the house, what your budget is, or what your tolerance for risk in investing is.

You may also choose to buy mortgage points to reduce your interest rate. Mortgage points are an upfront payment in exchange for lower interest rates over the life of the loan. They don’t reduce the amount of the loan itself, though. $125,000 is still $125,000 whether you paid points for a lower interest rate or not.

Home Appraisal

The home appraisal is separate from the home inspection. An appraiser is a third-party entity that inspects the house and reports on the value of the home to both you and the lender. The appraisal is an estimate that tells you whether you’re paying a fair price and tells the lender whether they are making a good investment. If the appraisal is less than the asking price of the home, the lender may be less willing to approve your loan. You are responsible for paying for the appraisal, though the cost is usually worked into your closing costs.

Buy Homeowners Insurance

You’ll need to purchase homeowners insurance. Unlike renting, which usually doesn’t require you to buy renters insurance, you need insurance to own a home. Call or click around and get some quotes. If you have a car or other type of vehicle insurance, you may be able to get a bundle discount on homeowners insurance through the same company. Homeowners insurance will protect you and your valuables in the event of an emergency or severe property damage.

If you are putting less than 20% down, you will also need private mortgage insurance. You can get this through your mortgage lender or a different company or through the Federal Housing Administration. PMI is removed from your payment when you owe less than 20% of the value of the home, per your original loan agreement. Some choose to refinance their mortgage to get out of PMI earlier if their home value increases or they pay off the loan faster than anticipated. At closing, the lender must tell you how long you have to pay PMI for.

Contact a Real Estate Attorney

Your lender or real estate agent can probably recommend a reliable real estate attorney. You’ll have to pay for their services, which can be pricey, but in the long run it’s worth it to know your home purchase is legally sound. Some states require an attorney at closing and others don’t so check laws in your area. A real estate attorney will help draw up paperwork, answer legal questions, ensure the title to the property is in good order, and will be your right-hand gal or guy at your closing. Personally, I’m always afraid of getting ripped off in big financial transactions like this, so having an attorney handle the paperwork made me feel safer.

For unmarried couples or partners or roommates buying together, it’s really important to work with an attorney to ensure all parties’ rights are protected. Ideally, find an attorney who has worked with LGBT buyers before. For example, we bought our home before marriage was legal at the federal level, so even though it was legal in our state, our attorney advised that we both be named on the title and contract. Attorney fees can be included in closing costs.

THE CLOSING

It may feel like the closing date is never going to come — or on the flip side, it could feel like it all happens really fast! Typically, a closing on a home being purchased with a loan will be scheduled 30-45 days after the loan approval. A cash sale might be sooner. A closing date might be later if the buyer has to wait for a lease to end or the seller has to wait for the sale to go through in order to purchase their new home (a contingency sale).

On your closing date, you’ll meet with your attorney (or agent) and sign a billion gazillion papers and pay your closing costs in full. Do some finger stretches. You’re going to be signing for what feels like forever! You’ll pay your closing costs, if you haven’t already, which can include the escrow, title fees, appraisal fees, attorney fees, inspection fees, and mortgage points you may have bought.

Finally, you’ll walk away with the keys to your new home at or shortly after closing! Ready your U-Haul!

Next week, we’re publishing a roundtable of real, live Autostraddle homeowners with some solid, real-talk advice for y’all! Stay tuned for that!

Have questions? Have homebuying and homeowning stories? Plan to rent forever? Share it in the comments!

Buying my home was the hardest thing I have ever done. Ever. And I moved to another COUNTRY when I was 22! I’m so glad I have my house and I love it so much and I never want to repeat the home buying process again. It was so worth it in the end, though. And in my area my mortgage payment is so much cheaper than renting an apartment. If you’re single, like me, though, it can be close to impossible to qualify for a mortgage on your own. I had zero debt (no car payment, no cell phone payment, no credit card balance), a 30% down payment, and my parents still had to co-sign. So watch out for that.

You had a 30% downpayment and you still had to have a co-signer? GEEZ. Number one: bravo on getting your financial shit together. Number two: I’m happy you’re in your home, too!

It was crazy! And it’s because I’m a single earner and don’t make much money. *I* know I’m responsible, but the debt ratio thing obviously doesn’t take that into account. I think I was at 51% at the time? I know I’m a lot luckier than most people and was able to live with my parents for a year and a half while I saved EVERYTHING. But damn if I ever want to repeat the process! BTW, this was house number 6 that I had put an offer on! I’m never leaving it lol.

It might come up in a later article, but it would be worth mentioning the low income options for utilities. I have a discount on my electricity bill and water bill because I qualify as low income. Hopefully people already know about this option and are taking full advantage, but I was surprised at how much I’m discounted on my electricity bill.

i save pictures of my dream house on pinterest, so to say i long to own my own home is an understatement. I’m going back home to kenya at the end of the year, possibly for good, so i’m not looking to buy a home in the states. If I were to however, I would definitely look at houses up for auction. I don’t mind fixer uppers, in fact I’d probably end buying one that needs some love. I’m fortunate however, in that I have friends who have the know how on things like the state of the foundation or roof. There was a wonderful starter home i drove by going for 65k. it needed work, i’m willing to admit, but man it haunted me before someone bought it

Oh yeah, @monalisa, a couple years before we were ready financially and emotionally to buy, we drove past a house in our neighborhood that was listed for $59k and fell in love with the IDEA of it. It was this cute, compact purple house with a yellow picket fence and a tiny front yard. It was SO CUTE. We started stalking the listing online and almost called an agent, but then it sold. We now own a larger house with a real backyard just around the corner from the purple house. I’m sure it was the right decision, primarily because neither of us is handy at home repairs/maintenance.

Omg this is so relevant to my interests! I’m looking to buy a house in spring 2018. I’ve been obsessively browsing Zillow and Trulia and reading every piece of first-time homebuyer advice I can get my hands on, but I always trust Autostraddle.com advice above all else. I’m nervous about how it’s going to go because 90% of the stuff I read elsewhere is tailored towards a straight, married, 30-something couple buying a 300K house and I’m a single 24-year-old (who is lucky enough to live somewhere with very affordable homes!)

Thank you for writing this, KaeLyn, and I’m so excited to read everyone’s homeowner stories and advice next week!

Good luck, @marfy! I feel in my heart that you’re going to find the PURRFECT place!

I also don’t understand buying a $300k house, though I know that’s how much houses cost in many places. One of the reasons I ended up putting down roots in Rochester, NY (western/upstate NY) instead of a big city like NYC is that the housing market is so much more affordable here! I’m not shy about talking about money and I can tell you that we bought an updated 1920 house with 4 bedrooms, 1.5 baths, and 1616 square feet for $115k. That wouldn’t buy a decent apartment in a bigger city!

Legit. I left NYC last year partially because of this. We’re going to end up spending more than you did, probably around 150-175 for a 1920ish home in the 3/1.5/1400 range, but that’s still just chump change compared to the city. (I still love and miss you city, but for real…)

I had to go look – literally the cheapest house in Vancouver right now is $998K. And that’s a teardown being sold for land value.

Granted this is CAD $, but that’s still approx $800K US.

We bought our house (sososo grateful) over 10 years ago for $382K (CAD – so about $304K US), and could only manage it because it came with a tenant in the basement suite, and my wife had money from when her mother and her grandmother had died for the down payment.

Having tenants (we now have two) has made all the difference for us in being able to live in our own home. I really really recommend considering if there’s part of the home you could rent out ( whether separate or a bedroom/ shared living situation/ taking in students) either to afford the mortgage or as a backup plan if work/money situations change.

Also, our home was the actual cheapest house in Vancouver when we bought it, and we spent the first year with plastic bags taped to the ceiling where the rain was coming in until we could afford to get the roof fixed.

I love love love our house though; isn’t it cute?

Here’s our intention list from before we found our home:

You’re house is soooooo cute!!! Puts my boring townhome to shame.

It’s a great house, lots of character

Congratulations

What a beautiful house!! So glad you were able to find it, and that garden looks amazing!

Thank you!! :) Yes, I live in Memphis where 300K will get you a 5 bed/3 bath sitting on 1 acre with granite countertops and a swimming pool. I’m looking at 1950s bungalows that will hopefully be around 125K. Nashville (where I grew up) is a completely different story. Developers are buying up every available house, tearing it down, and building a 3-story monstrosity of a duplex in its place that will then sell for close to a million dollars.

Good luck! I hope you find a home that will nurture your dreams and be someplace wonderful to come home to ?

With bungalows you have less to worry about (no plumbing above your head, you can reach everything more easily), and paint and plants work miracles to make it your own without a ton of extra money ( especially if you know people willing to give you baby plants from their garden, which many people will ?).

Hope to see a future post about the wonderful home you found!

I have been thinking about this lots – I told myself that once my monthly rent cost surpassed the $1,000+ mark, I would start looking. Welp, that time has come, but I am hesitant and these daily Zillow emails are a bit depressing but also give me a bit of hope? Like, yeah my partner and I can totally afford to own but the future is so uncertain. Especially with Cheeto Stain in charge. I worry about the economy. I worry about my job stability.

Having said all this, thanks for this very informative post. I will come back to it for reference as I clearly had not much of an idea where to even begin. :)

It’s a huge life and financial move to enter into a mortgage agreement. I don’t think you’re being overly cautious, @pixels! We probably rented for two years past the point that we felt like we should be buying because we were hesitant to make the move due to our already significant school loan and credit card debt. There’s a lot to worry about in this economy and in this political reality!

I’m not planning to leave Nevada for another couple years, but I regularly trawl zillow and day dream. Someday I’ll find the right place, hopefully on the east coast

Those home-owning daydreams are the such a lovely ache, @ellesbells! All the longing with none of the responsibility! It sounds like you’re making the smart choice if you’re planning to move East eventually. Enjoy the perks of not-having-a-home-you-have-to-upkeep while you can!

AHHHH i just spent my weekend at a bunch of open houses and this is so fucking timelyyyyyy

i am both excited and terrified by the prospect of owning a home- thanks for being frank about the unique issues to purchasing a home as a queer human!

YEAH! Good luck with the housing search, @bluebluebaby! You’re going to CRUSH IT!

Literally just had our home loan approved yesterday!

We started looking in about March I think, so it’s been a long journey. We saw about 30+ apartments, we made a spreadsheet etc etc. If you are buying an apartment or a townhouse, don’t forget to think about the body corporate rates (I think they’re called HOA in the states?) and council rates etc. We also made note of potential rental prices in the area so that we know what we could get if we have to move and rent the place out.

We put in our offer about a month ago, we negotiated and then it was finally accepted and then we waited about 3 weeks for the bank to approve our loan.

It was also really helpful to go to the mortgage broker (do they have those in the states?) at the beginning to get a good sense of how much deposit we would realistically need so that we had a goal figure to save towards.

Anyway, I’m so excited for the round-table! And excited to talk about boring grown-up things like buying houses. And so fucking excited to own my own tiny box of a home.

I forgot to mention issues specific to buying an apartment or townhome, so thanks for bringing that up!

Congratulations! I’m so excited for you, @gem-2!

A huge upside to having an HOA, though, is insurance. My homeowners insurance is next to nothing because the HOA covers the structure. Also, I don’t have to mow my front lawn ;)

Another thing to be concerned with when buying a condo/shared building dwelling is the underlying financials of the condo association. Some have fairly low dues, but not much cash on hand, which can lead to drastic increases for which you will be liable when something happens to the community property.

Can you please write the Aussie version of this article? I’m likely getting involved in buying an apartment soon and I barely know how bank stuff works here because until very recently my visa situation made things weird.

Advice: pay for the sewer scope!

Absolutely pay for the sewer scope. You don’t want surprises in that department

I get the sense that this advice is #tooreal for you, @adunlap! Good advice!

best advice we got when we were buying, from friends who didn’t and really, really regretted it!

Yes! Any other specific testing/inspections we might be forgetting?

mold testing! particularly if the house is older, has a basement, and is in an area with a high water table. if we had just known to request the $100 mold test during inspection, we could have saved thousands of dollars in remediation costs!

As an insurance agent, this stuff gets me a little excited. *blushes*

Oh and at the very least, you might be able to find a queer-friendly insurance agent.

https://onallstate.com/lgbt/?CID=OTC-DNSR-GR-120523&att=lgbtallstateonline

Yes! Like yooooouuu, @soniyeaaah! Actually I feel like a lot of insurance companies are specifically queer-friendly these days. Do you feel the same can be said for trans-inclusiveness in the insurance world?

Sorry I didn’t see this before! To answer you question: I WISH insurance companies would be more trans friendly. I have a trans friend I insure and, though I haven’t had a formal discussion with them about this, it irks me that their gender isn’t appropriately listed on their policies. Because I am supposed to be their trusted adviser and I don’t feel like I can be that person if it looks like, at the most basic level, I’m dismissing their identity.

The overall issue is that rating/premium is calculated by statistics, and companies who collect data have to get on board first so that the statisticians can tell insurance companies, “hey historically, trans people are safer/riskier drivers than the typical person.” When they have that data, then they can rate people more appropriately and list appropriate gender identities on policies.

The other thing is that insurance is super white, super male, and super old. We are definitely seeing a new generation of agents in the field but it’s still pretty stagnant in the leadership positions, which is really where decision making is.

So I’d hope to see insurance companies get more trans friendly going forward. I’d love to see the big data companies get on board with this as well because that’s who we depend on to make our rates. I think it will happen in the future, it’s just a matter of when.

But hey what do I know, I’m just a young naive insurance agent ;)

Thank you thank you thank you! We are starting to start this process and I feel so overwhelmed by the amount of things I don’t know about homebuying. This made me feel slightly more overwhelmed because it made me realize there’s even more I don’t know but also this is an awesome resource to make there be fewer things I don’t know.

My wife and I bought our first house six years ago.

The best thing we did was to stick with our list of must-haves and our budget (accounting for some significant move-in, fix-it costs, property taxes, etc…)

When I think of houses we considered that we outside of those parameters, I realize it was a waste of mental capital.

I am a really domestic person. The time spent on the house and the garden is very rewarding and a great distraction from the larger political realities outside. It nice to have our own little oasis in the storm.

I’m probably a forever renter because house prices in my city are ridiculously high and I don’t want to live in a suburb.

But I’m posting in support of more adult-relevant articles. I’d love a “how to plan for retirement, aka, what’s the deal with 401Ks and how do I pick ethical companies to invest in” post.

I fully support the request for more #OlderStraddle content

Pitch us, @carmensandiego!!!!!!!!! I’d also love to read an article about retirement, which I feel like I’m only half-ass preparing for right now.

@kaelynrich

Let’s see… Getting ready for retirement, getting debt under control, turning work friends into regular friends, meeting the parents while gay, prenuptial agreements, lesbian wedding stuff, taking care of your older parents (queer angle if they don’t accept your partner), long term relationship column (Bren? Heather? Laneia?), the end of a long term relationship, pet custody battles…

You guys may have done some of those before but still

Oh, and Kegel exercises

And don’t half-ass your retirement, full-ass it!

Does your company have a 401k? Does it match your contribution?

Open a Roth IRA if you can

Haha. I guess I’m kind of 3/4-assing it. I have a roth, but I haven’t maxed it out yet–it’s my goal to get there this year as soon as I pay off a few major credit cards. (I just got a raise at work, so I can finally make a significant dent in my debt pay-off plan) I also have an employer-paid pension at work, which I 100% vest in in January 2019. My spouse has a 401k and maxes out the employer match (6%). And we have supplemental whole and term life insurance, but, like, mainly just to cover our asses if one of us unexpectedly dies–enough to pay off the mortgage and all our combined debts. That’s my plan? How many asses is it?

What if you just gave financial advice to me as an article, @carmensandiego. I’d take you up on it! I wish my financial planner was not a nice white cis straight guuy!

ALSO, I’m seriously saying you should pitch and write some of these! I think the people are hungry for it and you’ve got the info! Esp on the financial planning stuff!

Me? Writing an article? I don’t know, I don’t feel comfortable as English is not my first language

@carmensandiego you could ABSOLUTELY write a #OlderStraddle article we’d all want to read.

We read about an article a week in commentary from you, don’t we ??

@carmensandiego I can help look over it for language stuff if you’re concerned, I’ve done a lot of editing work with ESL folks :)

Seconded. I’ve been a homeowner for 11 years, so this doesn’t particularly apply to me, but I’d love to see more of this kind of adult-oriented content. I won’t call it ‘older’, though, because I was 21 when I bought my first house and 21 year old me doesn’t identify with ‘old’ the way 32 year old me does. ?

Yes please!

**Meryl Streep yelling at SAG Awards pic** LOOK INTO INDIVIDUAL DEVELOPMENT ACCOUNTS; they’re matching-grant programs that vary from state-to-state for first-time homebuyers (or for education/businesses), based on income qualification. I don’t know much about other IDA programs other than Oregon’s, but this is how boss it is–if I save $1,000 per year for 3 years, they’ll match that 3-to-1 so that I come out of the program with $12,000 to spend on a downpayment. (In Oregon, it’s also possible to complete the program in 2 years & receive the maximum benefit).

That is *nine* *thousand* *dollars* of free money.

That sounds awesome, @jayare!

This is thoroughly researched and truly fantastic advice. I am extremely impressed. This accountant approves this message.

Your financial posts are always on point.

Well done, KaeLyn

@carmensandiego, you know that’s the highest praise. You make me…

Seriously, though, I appreciate it because I’m definitely self-taught on finance stuff. (Thanks, internet + school of life) I’m also horrible at math and totally left-brained, which I know isn’t incompatible with financial planning, but I feel like it’s probably not my natural area of expertise. Your opinion means a lot to me!

It was 700% earned and well deserved praise.

My only advice would be – be prepared to hate every second of the process. It’s tedious, disappointing and you have to involve rude people you’d never give $$$$ under any other circumstances.

Seriously. It was one of the top three worst, most stressful experiences of my life.

Oh and don’t trust anyone. I had a full survey done which didn’t reveal the gas boiler had been condemned (the engineer said it was the worst he’d seen “outside of a fatal incident”). Plus none of the white goods were plumbed in. Sure, the dishwasher light turned on when you switched it, but there was zero plumbing and that’s how I spent my first night there weeping and mopping up gallons of water.

I am going to die in this house because I’m never going through that again.

THAT SOUNDS HARROWING, @restingbutchface. I’m so sorry that was your experience.

No joke, I spent SO MUCH MONEY on therapy trying to cope with the whole process. Never again.

My only advice would be – be prepared to hate every second of the process. It’s tedious, disappointing and you have to involve rude people you’d never give $$$$ under any other circumstances.

Seriously. It was one of the top three worst, most stressful experiences of my life.

Oh and don’t trust anyone. I had a full survey done which didn’t reveal the gas boiler had been condemned (the engineer said it was the worst he’d seen “outside of a fatal incident”). Plus none of the white goods were plumbed in. Sure, the dishwasher light turned on when you switched it, but there was zero plumbing and that’s how I spent my first night there weeping and mopping up gallons of water.

I am going to die in this house because I’m never going through that again.

I’m buying a house by myself at the moment, and it’s super stressful (will it all fall through before completion? who knows!) but I hope it will be worth it to have a place of my own with a cat flap leading out to the garden for my little pal Milly.

Good luck, @juniordrumkit! I’m excited for you!

Best. Gif. Reaction. Ever.

I do my best, @queserasera!

Great idea for a series. I’ll second the call for more financial, Will related Enduring Power of Attorney and Superannuation, type series too.

My partner and I’ve sorted all of this out ourselves as most people do as they have need for the info over the years. I’ve just been in a situation though, with a friend of ours who is retiring next month at 65 and who has done none of these things properly and now needs real intervention to help her put everything in place so that she’s financially and legally safe.

It’s never too early to take care of your legal and financial health.

That all would be awesome and personally helpful to me, too! I have to admit that my financia and legal house is not 100% in order. We don’t have a will because we honestly didn’t prioritize it before we had a kid.

So sorry about your friend, @pussiesbow! That sounds really stressful for her and you. Glad she has a friend like you to support her through it!

Thanks KaeLyn, these things are so important but because they involve time, some money and a fair bit concentrated organisation to get your head around they often get put off for another day.

We close on our first house next week!

AWESOME!!!

This is incredibly helpful and timely for me! I have a very personal question that you don’t have to answer because I know there are books I could read with this sort of information, but I would of course appreciate your take: were you married to your partner when you bought your home? If not, how did you work out a contract to determine who owns the home, or if both of you co-own?

I’m an open book, @libraryscientist! Waffle and I were married, but it was only recognized by NYS, not at the federal level. So we had both our names listed on the title and the contract as co-owners. Technically, I’m named as the primary owner and Waffle is the co-owner. We didn’t draw up any additional legal papers. If you are not married, be sure both your names are listed and that you both sign everything as co-owners.

Really helpful article! I’d also throw in that if any kids are spending significant time in the home, definitely opt for lead testing during the inspection. Homes are the source of almost all lead poisoning for kids, and you’d be shocked how common it is to have lead paint (or pipes, but paint is how most kids are exposed) in homes built before the 80s.

Also if your area was formerly the site of any industrial activity, opt to get soil samples taken and tested for everything from lead to all the other heavy metals and industrial waste. If you’re not sure about the area’s history check with the local council or I think you call it the City Hall in the US.

Great advice – thanks KaeLyn! My partner and I complete on our house-buy literally *tomorrow* and move house next week – and I am beside myself with excitement and joy. I can’t believe how lucky we are to be able to “own” (haha) a home of our own. It’s been a long and stressful journey to get here (today being the most stressful of the lot) but oh my god, the thought of being able to do what we want and feel secure in a space of our own? WORTH IT.

Looking forward to the roundtable – hopefully will be reading it from my new kitchen table!

Congratulations! Will you still be on Skye?

I feel like you are someone who would understand if I told you that we promised our home~ house that we would do our best to take care of her if she let us live there. I honestly believe that’s why everything went through for us, because previous people’s attempts to buy kept getting thwarted.

Wishing you energy for this end stretch and abundant happiness in your new home!

Thank you @snaelle!

No, massive curve ball, we are moving to Machynlleth, Mid-Wales (a place we both know and love.) Skye is magical, but just too expensive for us…and also, the public transport here sucks ;)

(And yes oh my goodness I get that about making promises to your home. How lovely that you did that! I bet your home is returning the love and holding you in love and safety. xxxx)

Wow @littleredtarot! That is a huge change. A different kind of magical, with gorgeous landscape around as well.

Do you speak any Welsh? If not, are you thinking of learning?

I don’t know if you’ve read any Diana Wynne Jones, but I love the magic and the feeling she has for the various energies and cultures around the British isles. She had a lot about Wales/Welsh mythology in her books due to her own background.

Haha, @littleredtarot! You’re in the roundtable! It was a million years ago that you contributed to it, though, so you’re prolly going to have to give an update for us all because it sounds like a LOT has happened since then!

Really? I wonder if it was about the boat?? But that’s going back 18 months… ah well it’s all valid stuff and The Way That We Live.

Congrats to you guys, too, on owning your own home. It’s such a big deal. I really appreciate your posts about credit, mortgages and that stuff, reminds me that it’s okay and possible to be a rad person who also lives in the mainstream world (I’ve done so much handwringing about getting a mortgage, entering the system…)

It’s about the boat!

If you want to change it up now that you are getting a mortgage, just let me know, @littleredtarot. I can change your answers if you want. It is probably from like a year ago, yes.

Seriously, so much to take it in. This could be a series.

Glad it was helpful, @cmo_allthetime!

Thank you, KaeLyn! I edit for a real estate company that recently put out an e-book about the home buying process, and this piece was just as informative if not more (thanks to the added queer perspective!).

Also, a resounding SAME to the requests for more financial and planning-for-the-future articles. When I asked my dad how to get a will drawn up, he laughed at me :|

My last will and testament and my health care directive are from LegalZoom

https://www.legalzoom.com/personal/estate-planning/

And yes, KaeLyn did a magnificent job here

This is a fantastic article! Can we have more budget planning articles and financial health focused ones? I love a queer perspective, and an inclusive mindset. Maybe an article about post college budgeting and financial planning?

Check these out, @jane123! I definitely hear the request for more “grown up” content. I know it’s something the editors are interested in, too!

Broke As F*ck: The Lifestyle Guide

When Two (or More) Become One: Relationship Budgeting for the Financial Planning Adverse

I like this article. There is a lot of useful info even for me, a student who wants to build a career in the real estate field. I enjoy researching information from additional sources such as your article or quizzes here https://quizzes.studymoose.com/flashcards/real-estate/ , which makes me less narrow-minded. Thank you for sharing!

Thank you!